Where there is trade, there is pricing. What should be the pricing of carbon units? For example, the price of carbon units in the European Emissions Trading Scheme in 2022 fluctuated widely. In mid-August, it was at €98/tCO2 eq and fell to €65/tCO2 eq in early September, coming close to its lowest level since the beginning of March 2022.

However, the developed and mandatory European market cannot be compared with the emerging and voluntary Russian market. Only two sales and purchases of carbon units have taken place on the Moscow Exchange so far, and experts agree that it will take time to reach an adequate price.

The carbon charge can vary

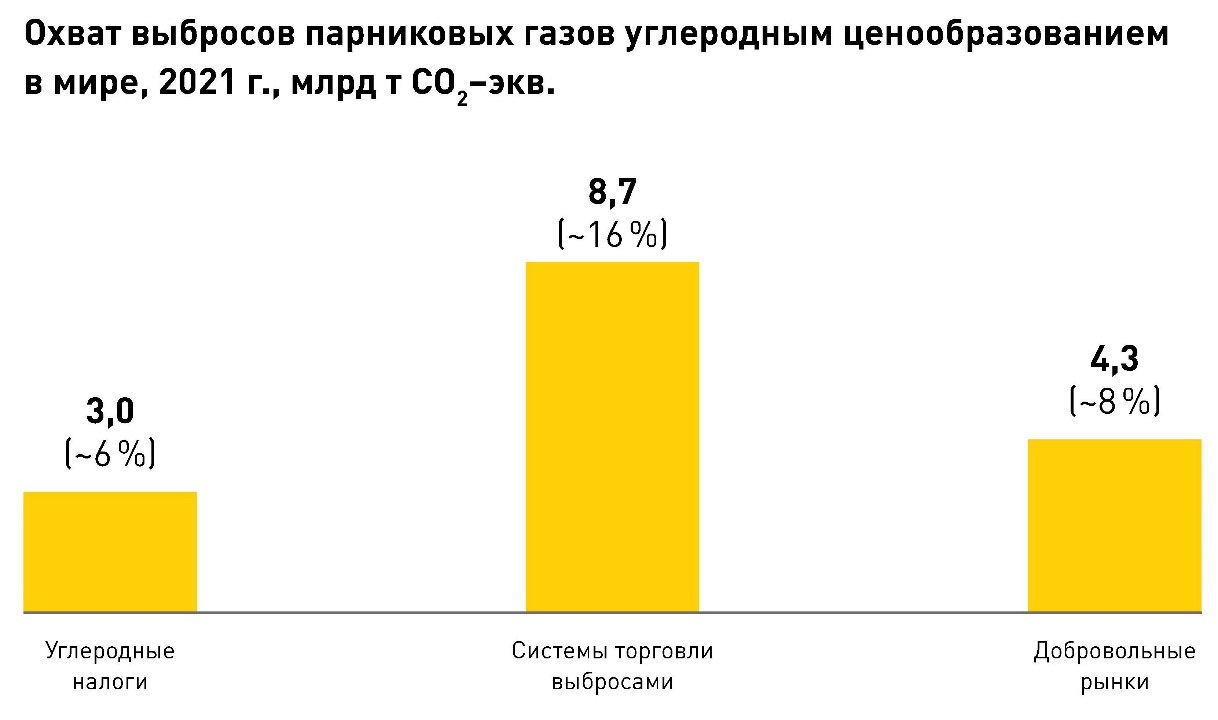

Carbon pricing involves setting direct charges for greenhouse gas emissions, and these can be quite different systems.

- Carbon tax. The government sets a flat rate on greenhouse gas emissions or, more commonly, on the carbon content of fossil fuels.

- An emissions trading system. In this case, the authorities set a permitted amount of emissions for regulated companies for the reporting period and levy penalties for exceeding it. A market for trading permits is formed: companies that reduce their emissions more than allowed are sellers, while companies that exceed their permits are buyers. Carbon-intensive sectors are the first to be included in cap-and-trade systems.

- Voluntary carbon markets. This system allows companies to offset greenhouse gas emissions by purchasing carbon units from climate projects. These can be projects that reduce emissions or that increase removals.

Voluntary markets are the most versatile instrument, and can be implemented in any economy and even be used to conduct international sales transactions. It is the voluntary market that is now taking shape in Russia. That said, different carbon pricing options can operate simultaneously in the same territory, and there are examples.

Note: Voluntary markets may have some overlap with carbon taxes and emissions trading systems. Source: World Bank and Ecosystem MarketPlace

Socio-economic effects of carbon pricing

Carbon pricing has notable effects on the economy, which need to be taken into account in both introduction and market development. Estimating the effects of different carbon pricing options allows the selection of the preferred option. However, most studies estimate the effects of a carbon tax, and less often they estimate the effects of a voluntary market.

In Russia, the estimation of the socio-economic effects of carbon regulation is becoming more widespread and it makes sense to conduct it for carbon pricing options as well. All the more so because Russia’s climate objectives explicitly include a condition for sustainable and balanced socio-economic development.

The effects of carbon pricing are as follows.

Greenhouse gas emissions. Putting a price on carbon leads to lower greenhouse gas emissions. However, there is no direct linear relationship. Much depends on the level of emissions, the country and the incentives.

Source: Authors’ analysis based on research by Acadia Center, Duke Kunshan University, European Commission, Grantham Research Institute on Climate Change and the Environment, IMF, IMF, OECD, VTB Capital

GDP. The introduction of carbon markets entails lower GDP growth, as evidenced by studies of the world as a whole, the EU and Russia. This is due to higher prices, higher costs and lower output in traditional sectors of the economy. But the experience of a number of countries shows that the effect can be minimal (British Columbia province, Canada) or even contribute to economic growth (a number of states in the US).

Investment. As a rule, investments in carbon-intensive industries (oil and gas, coal, traditional metallurgy, etc.) are reduced, while investments in alternative sectors of the economy (RES, alternative transport) are increased.

Inflation. The carbon market leads to rising inflation as the production costs of carbon-intensive products rise, as do the prices of electricity, heat and fuel. In Russia, for example, the INP RAS estimates that a carbon price of €50 could increase heat prices by 80 per cent and electricity prices by 25 per cent.

Employment of the population. It is rather difficult to trace the relationship because there is no direct correlation between jobs and the carbon market. In Russia, total employment in these sectors is relatively small, despite the significant economic role of fossil fuel extraction and processing. But if the Sakhalin Oblast Climate Change Programme (2021) is considered, it will create at least 1,000 green jobs by 2025.

Costs to the public. The introduction of carbon pricing raises costs because of increased costs for socially important goods such as electricity and heat.

In Russia, the cost increase can also be limited by state regulation of electricity and heat prices. The burden from cost increases will not be direct, but may be felt at the level of general inflation, as indirectly household expenditures will increase anyway.

Estimates and realities may differ

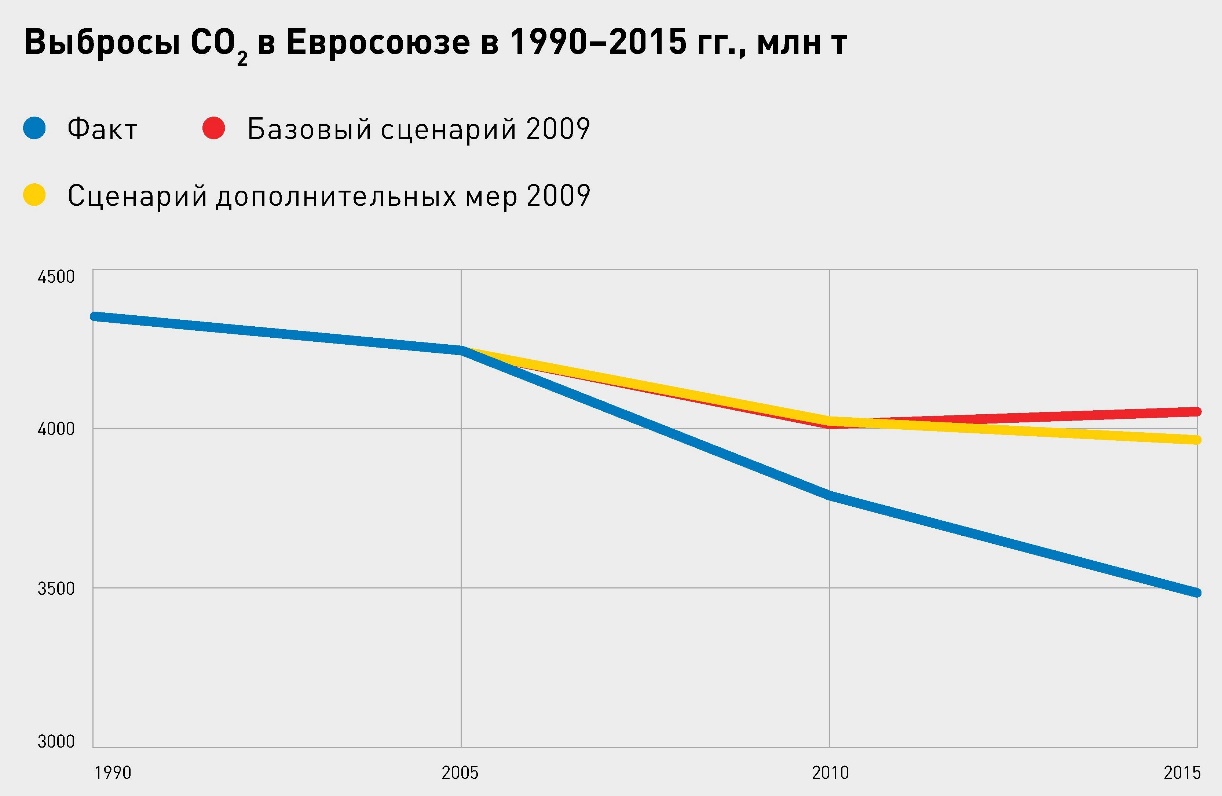

The effect of carbon pricing can only be estimated. Especially in Russia, where the market is still emerging. Starting down the road does not preclude taking advantage of the experience of countries that have been exploring this area for years in practice and, incidentally, have been wrong in their predictions.

Source: European Commission

As an example of wide divergence, EU CO2 emissions in 2015 were 570 million tonnes CO2 and 480 million tonnes CO2 less than the baseline and the 2009 supplementary measures forecast, respectively. Moreover, the large deviations between fact and baseline were one of the destabilisers of the European system in its first phase (2005–2007), when “allowed” emissions were steadily higher than actual.

Cover photo: © Sergey Nivens / Laurie photobank

Comments