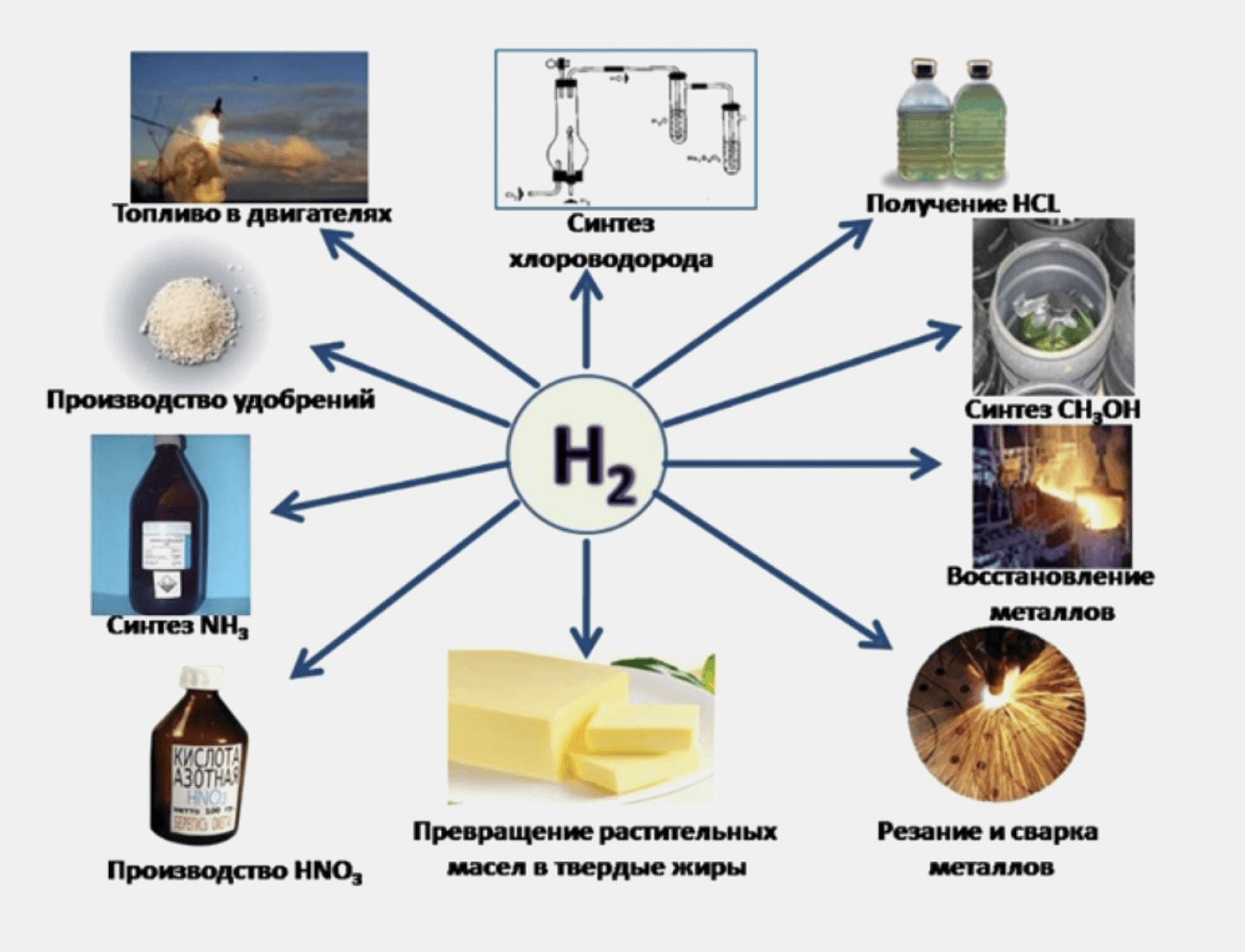

Hydrogen, a colourless, tasteless and odourless gas, the first and lightest chemical element in the Mendeleev periodic table, has long been well studied. It is widely used in a variety of industries, including metallurgy, power generation, petrochemical, chemical, pharmaceutical, food, glass, electronics and electrical engineering, ore enrichment and nuclear fuel production. Liquefied hydrogen is used as rocket fuel (Figure 1).

Figure 1. Industrial applications of hydrogen

Figure 1. Industrial applications of hydrogen

Image: open sources

In the last century, the scientific literature substantiated the prospects of using hydrogen to store “excess” electricity generated by solar and wind farms. The fact is that electricity generation peaks at solar and wind power plants do not always coincide with consumption peaks, which can result in a situation of excess energy, an excess of generation over consumption. In this situation, either the solar and wind farms must be shut down, which is not economically viable, or this excess energy must be stored for later use as needed.

Most experts agree that the best solution for this is hydrogen (referring to the conversion of energy generated in solar and wind power plants into hydrogen by electrolysis of water). In contrast to batteries, which can store energy for a limited time and whose capacity will not keep pace with the development of energy systems, which are mainly fuelled by renewables, in the medium term hydrogen can be stored for a long time and in arbitrarily large quantities. Therefore, hydrogen and electrolysers are now seen as a mandatory component of energy systems with a high share of solar and wind generation to ensure their sustainable, uninterrupted operation 1.

In recent years, however, interest in hydrogen has gone far beyond energy storage. It is now seen as a key link needed to decarbonise various sectors of the economy and to achieve climate neutrality (a balance of anthropogenic emissions into the atmosphere and greenhouse gas removals from the atmosphere) by mid-century, in line with the aims and objectives of the Paris Agreement and those specific commitments to move towards a low-carbon development path undertaken by the countries participating in the Agreement. Many of them have established national hydrogen strategies, hydrogen economy plans and dedicated budgets to address the related scientific, technical and industrial challenges.

As you know, hydrogen is not extracted in its pure form from deposits; it has to be produced. Therefore, the main issue that is currently being debated is the choice of technology, the method of hydrogen production.

Currently, hydrogen is produced mostly from fossil fuels — primarily natural gas, but also from oil and coal. In doing so, a significant amount of greenhouse gases are emitted into the atmosphere. From the point of view of solving climate problems, this is unacceptable. The whole point of switching to hydrogen is precisely the possibility of reducing greenhouse gas emissions. Obviously, fossil hydrogen (also called “grey hydrogen”) is not suitable for this purpose. But it can be decarbonised using carbon dioxide capture and storage (CCS) technologies. Hydrogen that is produced from fossil fuels using CO2 capture technologies is called “blue” hydrogen. Hydrogen that is produced by electrolysis of water using renewable energy is called ‘green’ or ‘renewable’, and if energy from nuclear power plants is used, ‘pink’ or ‘red’.

The climate discourse declares the unconditional priority of “green” hydrogen. The commodity companies promote “blue” hydrogen, the countries with a large share of nuclear energy promote “red” hydrogen. The European hydrogen strategy tries to reconcile all stakeholders and uses the term “low-carbon hydrogen”, which includes all the above-mentioned forms of hydrogen except “grey”.

Despite the lively discussions about the future role of hydrogen and the advances made, its production and application in the world for climate purposes is still in its infancy. The projects initiated and implemented in this area (albeit quite numerous) are mostly pilot projects and in all cases require government support up to and including direct co-financing from the budget due to the novelty of the technologies used and the lack of full market value chains.

However, all projections predict significant growth in global production, exports/imports and consumption of low-carbon hydrogen, as well as a reduction in its cost (price) by 2050, although there is wide divergence in the quantification of these parameters.

For example, the Hydrogen Council estimates that annual hydrogen consumption will increase from the current 94 million tonnes (2021 data) to 660 million tonnes by 2050. The IEA considers that the scenario of achieving carbon neutrality on a global scale by 2050 corresponds to an increase in annual hydrogen consumption to 530 million tonnes. DNV GL predicts that hydrogen production in 2050 will be around 330 million tonnes. In its latest global energy outlook, oil and gas concern BP says the expected consumption range for hydrogen in 2050 is between 146 and 446 million tonnes, depending on the scenario. According to the Energy Transitions Commission the global demand for pure (“green” and “blue”) hydrogen and its derivatives, such as ammonia and synthetic jet fuel, will reach 500-800 million tonnes per year by 2050, with hydrogen accounting for 15% to 20% of final energy consumption.

This uncertainty is primarily due to the unclear prospects of the industries in which hydrogen is expected to be used. Another factor is the comparative efficiency of hydrogen itself against the available low-carbon alternatives.

All experts recognise that hydrogen is essential for decarbonising industries such as steel and fertiliser production. But the benefits of using hydrogen to heat buildings are not so obvious. Energy-saving measures, heat pumps and technologies to recover heat from ventilation and air-conditioning systems seem to be more preferable. The prospects for hydrogen in the context of the decarbonisation of vehicles and the production of electric cars are also not entirely clear. Chargeable batteries outperform hydrogen solutions in both the passenger car and truck segments.

However, it is too early to put an end to this. Hydrogen technology is now on the rise and could surpass the competition if its unit cost curve is steeper as sales increase.

For example, according to Rethink Energy, which released a report this January on the outlook for the hydrogen market, green hydrogen will be cheaper than grey hydrogen in just two years. Wood Mackenzie (WoodMac) predicts that by 2030 the cost of green hydrogen will fall below $2 per kilogram in many countries, and below $1 per kilogram in some. And Norwegian company NEL (a major electrolyser manufacturer) said in January 2021 that its goal is green hydrogen at $1.5 per kilogram by 2025. For their part, BloombergNEF (BNEF) experts state based on their market analysis that “green” hydrogen will certainly be cheaper than “blue” hydrogen, so it makes little sense to invest in the production of “blue” hydrogen.

But there are also opposing estimates. For example, in 2020, the consultancy firm Prognos commissioned a report by the German Federal Ministry of Economics and Energy (BMWi) entitled “The cost and conversion pathways of energy produced from electricity”, which was extremely pessimistic about the competitiveness of green hydrogen and synthetic fuels produced from it compared to conventional energy sources on the horizon to 2050. And in 2021, the German research centre Agora Energiewende calculated that even if the price of greenhouse gas emissions rose to €200 per tonne of CO2, this would not make green hydrogen competitive.

There are many questions about the logistics of hydrogen and its expected international trade (export-import).

Hydrogen Council predicts that by 2050, 400 million tons of the generated 660 million tons — that is about 60% — will be transported by pipeline and ships over long distances. At the same time, DNV GL experts believe that hydrogen in its pure form will be shipped mainly over short and medium distances, while ammonia (a substance containing hydrogen) will be traded around the world, as it is more convenient to transport.

They are opposed by representatives of the European electricity community, who argue that it is impractical and unprofitable to import hydrogen into Europe and that more renewable energy capacity must be built and hydrogen produced locally. This conclusion is supported by a number of analyses (e.g. a report by the British consultancy Aurora Energy Research, a joint paper by DIW Econ and the Wuppertal Institute for Climate, Environment and Energy or a report by the German think tank Agora Energiewende) which show that high transport costs and, in the case of shipping, also liquefaction costs, make long-distance transport of hydrogen unprofitable. It would be cheaper to produce hydrogen locally and import not hydrogen but synthetic hydrogen-based fuels (such as ammonia).

All this does not mean that the prospects for hydrogen are dim or that conventional technologies therefore have a chance of prolonging their lifespan. Decisions to decarbonise the energy industry and the global economy as a whole have been taken at the highest level with the participation of all countries and hydrogen has an important role to play.

Today the hydrogen economy is going through a formative period, many of its parameters have not yet been defined and will be refined in the process. But it is already clear that simply replacing the supply of fossil fuels with hydrogen and its derivatives is unlikely to be possible. A deeper integration of the economies and energy systems of many, if not all, countries will be required to ensure their secure, uninterrupted energy supply and sustainable low-carbon development based on green technologies and renewable energy sources, using hydrogen or other available solutions where necessary and economically feasible.

1 See, for example, Jeremy Rifkin’s acclaimed 2011 book The Third Industrial Revolution, which describes the widespread use of hydrogen as an energy store, a means of integrating increasing amounts of solar and wind power.

Cover photo: panophotograph / iStock

Comments